Progetto

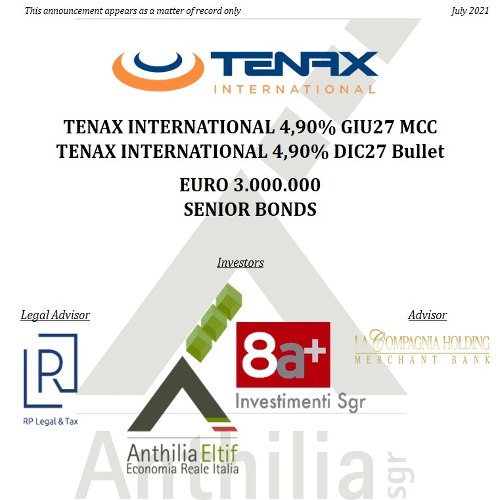

Tenax has issued two bonds, for respectively € 2.7 million and € 300,000. The first bond, listed on the ExtraMOT Pro3 segment of the Italian Stock Exchange, already subscribed for € 2.2 million by Anthilia, as a corner investor, and for € 350,000 by three other professional investors, expires in June 2027, has an amortizing repayment profile and is backed by MCC guarantee. The residual € 150,000 can be subscribed until September 2021. The second bond, unlisted, fully subscribed by Anthilia, has a bullet repayment and maturity in December 2027.

The proceeds from the issues are intended to accelerate the company’s growth path, mainly as regards the entry into new foreign markets and the implementation of new products to complete the current range, as well as investments in R&D.

| Emittente | Tenax International |

|---|---|

| Sottoscrizione Anthilia | 2,2 mln € |

| Durata | 6 anni |

| Cedola | 4,90% semestrale |

| Rimborso | Ammortamento a partire dal 3° anno |

| Garanzie | Fondo Centrale di Garanzia |

| Quotazione | ExtraMOT Pro3 |

Italiano

Italiano English

English